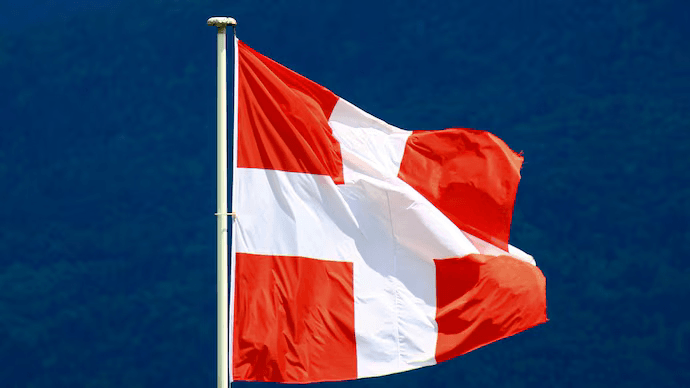

Switzerland Revokes India’s Most Favoured Nation Status Under Double Taxation Agreement

In a significant development affecting international taxation, Switzerland has suspended India’s Most Favoured Nation (MFN) status under the bilateral agreement designed to avoid double taxation. The move, announced on Friday, comes amid ongoing negotiations between the two nations to address issues related to tax transparency and compliance.

The revocation of the MFN status could have implications for Indian businesses and individuals operating in Switzerland, as well as Swiss entities with interests in India. The decision highlights the growing complexities in international tax agreements and the challenges of balancing national interests with global cooperation.

Background of the Agreement

The Double Taxation Avoidance Agreement (DTAA) between India and Switzerland was established to prevent individuals and businesses from being taxed twice on the same income in both countries. It was intended to promote economic cooperation and trade while ensuring fair tax practices. The inclusion of the MFN clause was a critical aspect of the agreement, as it ensured non-discriminatory treatment in tax matters between the two countries.

However, over the years, concerns have been raised about the implementation of the agreement, particularly regarding tax evasion, lack of transparency, and misuse of benefits by entities operating across borders.

Why Switzerland Suspended the MFN Status

Switzerland’s decision to suspend India’s MFN status is reportedly rooted in concerns about transparency and compliance with international tax standards. Swiss authorities have emphasized the need for stricter measures to ensure that tax benefits under the DTAA are not exploited.

Additionally, India’s increasing demands for data on financial accounts held by Indian nationals in Swiss banks have reportedly created friction. While Switzerland has been cooperating under global frameworks like the Automatic Exchange of Information (AEOI), the revocation of MFN status signals a need for further alignment on key issues.

According to tax experts, the MFN status suspension may be Switzerland’s way of pushing for amendments to the current agreement to make it more robust and aligned with international standards.

Implications for Indian Businesses and Individuals

The suspension of MFN status could result in less favorable tax treatment for Indian entities operating in Switzerland. For instance, tax rates on dividends, interest, royalties, and other forms of income might increase, potentially making Swiss investments less attractive for Indian companies.

Likewise, Indian businesses may face challenges in claiming tax relief for income earned in Switzerland. This could affect sectors such as information technology, pharmaceuticals, and financial services, which have a strong presence in the Swiss market.

For individuals, the change could lead to higher taxation on income sourced from Switzerland, such as salaries, pensions, or investment income. This could impact Indian expatriates living in Switzerland or those with significant financial interests in the country.

Impact on Bilateral Relations

The decision is likely to influence the broader economic and diplomatic relationship between India and Switzerland. While both countries have enjoyed strong ties, particularly in trade and investment, this development could add strain to ongoing negotiations on other bilateral agreements.

Switzerland remains one of India’s key trade and investment partners in Europe, and the two nations have collaborated extensively in areas like banking, pharmaceuticals, and research. However, tax-related disputes have occasionally strained the partnership.

Experts believe that both countries will need to engage in constructive dialogue to address the concerns and find a mutually beneficial resolution.

The Global Context

Switzerland’s suspension of India’s MFN status also reflects a broader trend in international tax policy. As countries seek to combat tax evasion and ensure fair practices, agreements like the DTAA are being revisited to close loopholes and address emerging challenges.

The Organisation for Economic Co-operation and Development (OECD) has been at the forefront of pushing for global tax reforms, including frameworks like the Base Erosion and Profit Shifting (BEPS) initiative and the AEOI. Switzerland’s decision may align with these global efforts to ensure stricter adherence to tax norms.

Next Steps for India and Switzerland

India and Switzerland are expected to resume negotiations to address the issues that led to the suspension of the MFN status. For India, the focus will likely be on ensuring that its businesses and citizens continue to receive fair treatment under the DTAA. Switzerland, on the other hand, will push for enhanced compliance and transparency measures.

Tax experts suggest that amendments to the agreement could include clearer guidelines on information exchange, stricter anti-abuse provisions, and revised tax rates to reflect current economic realities.

Conclusion

Switzerland’s revocation of India’s MFN status under the Double Taxation Avoidance Agreement marks a significant moment in their bilateral relations. While the move highlights the complexities of international taxation, it also underscores the need for collaboration to address emerging challenges.

As negotiations continue, both nations will need to strike a balance between protecting their national interests and fostering economic cooperation. For businesses and individuals affected by the decision, staying informed about developments will be crucial to navigating the changes effectively.

Also read-1. CRPF Constable Final Result 2024 Declared: 6779 Candidates Pass, Check Here

2. Gukesh Becomes Youngest World Chess Champion with Thrilling Game 14 Victory Over Ding.

Reference- Most favoured nation