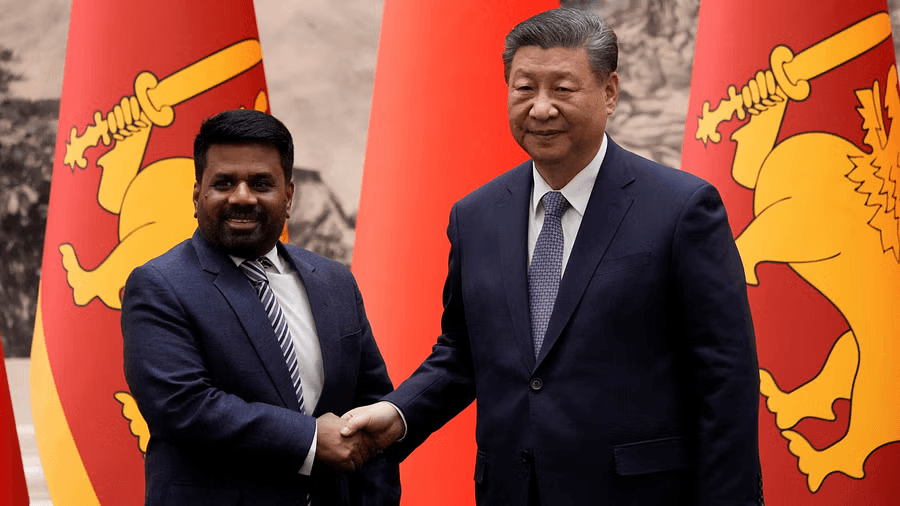

Sri Lanka has entered a groundbreaking agreement with Sinopec, China’s state-owned oil behemoth, to construct a $3.7 billion oil refinery in the Hambantota region. This monumental deal, the largest foreign direct investment (FDI) in Sri Lanka’s history, has sparked discussions globally. It holds the potential to reshape Sri Lanka’s economy, regional influence, and relationships with neighboring countries. Here are seven critical questions that explore the implications and significance of this landmark deal.

1. What Does the Deal Entail?

The agreement between Sri Lanka and Sinopec includes the construction of a state-of-the-art refinery with the capacity to process 200,000 barrels of crude oil daily. Located near the strategic Hambantota Port, the facility is designed to serve both domestic and international markets. A significant portion of the output is earmarked for export, potentially making Sri Lanka a regional hub for petroleum products.

The refinery is expected to be completed within four years and will include advanced technology to reduce environmental impact. This venture is part of Sri Lanka’s efforts to attract foreign investment and diversify its economic base amid a challenging recovery from its 2022 financial crisis.

2. Why Is This Deal Significant for Sri Lanka?

Sri Lanka has struggled economically in recent years, with the 2022 crisis marking its worst economic downturn since independence. The country defaulted on its debt and faced severe shortages of fuel, food, and medicines. This agreement represents a turning point, injecting much-needed capital into the economy.

The $3.7 billion investment is expected to:

- Boost Foreign Exchange Reserves: By exporting petroleum products, Sri Lanka could generate significant foreign exchange earnings.

- Create Jobs: The project will provide employment opportunities during construction and operational phases, particularly in the Hambantota region.

- Enhance Energy Security: A local refinery will reduce dependency on imported refined products, stabilizing fuel availability and prices.

3. What Is the Strategic Importance of Hambantota?

The Hambantota Port, located near vital shipping lanes in the Indian Ocean, has been a subject of strategic interest for years. In 2017, Sri Lanka handed over the port to a Chinese company on a 99-year lease after struggling to repay a Chinese loan. This raised concerns about China’s growing influence in the region.

The new refinery further solidifies Hambantota’s role as a strategic energy and logistics hub. While it promises economic benefits for Sri Lanka, it also increases China’s footprint in the Indian Ocean, potentially altering the geopolitical landscape.

4. What Are the Geopolitical Implications of the Deal?

China’s investment in Sri Lanka is part of its broader Belt and Road Initiative (BRI), which aims to expand Beijing’s global influence through infrastructure projects. However, the deal has raised eyebrows in neighboring India and other Western nations.

- India’s Concerns: India has traditionally viewed Sri Lanka as part of its sphere of influence. China’s growing presence in Hambantota is seen as a challenge to India’s strategic interests in the Indian Ocean region. New Delhi may seek to counterbalance this through increased investments or diplomatic engagement.

- Western Reactions: The United States and its allies have expressed concerns about China’s debt-trap diplomacy, where infrastructure loans are used to gain strategic leverage. This deal may intensify scrutiny of Chinese investments in smaller nations.

5. Could the Deal Backfire for Sri Lanka?

While the agreement offers immense potential, it is not without risks:

- Debt Dependency: Critics argue that Sri Lanka could deepen its reliance on Chinese financing, potentially compromising its sovereignty. The Hambantota Port lease is often cited as a cautionary tale.

- Environmental Concerns: Large-scale industrial projects can have significant environmental impacts. Proper safeguards are crucial to ensure sustainable development.

- Operational Challenges: Managing such a large project requires strong governance and oversight. Mismanagement could lead to cost overruns or delays, undermining public trust.

6. How Does This Deal Affect the Regional Energy Market?

Lanka’s entry into the petroleum export market could reshape the regional energy landscape. With advanced refining capabilities, the Hambantota refinery could compete with established players in India, Singapore, and the Middle East.

This development may also:

- Lower Fuel Costs: Increased regional supply could stabilize or reduce fuel prices in South Asia.

- Attract Further Investments: Success in this project could draw additional FDI into Lanka’s energy and logistics sectors.

7. What Does the Future Hold for Sri Lanka?

The Sinopec deal could be a game-changer for Sri Lanka, providing a much-needed economic lifeline. However, its success will depend on effective implementation, transparency, and balanced foreign relations. To maximize benefits, Sri Lanka must ensure:

- Strong Governance: Clear regulations and oversight mechanisms are essential to manage the project effectively and prevent corruption.

- Diversified Partnerships: While China’s investment is welcome, Lanka should also engage with other nations to avoid over-reliance on a single partner.

- Focus on Sustainability: Incorporating green technologies and minimizing environmental impact will enhance the project’s long-term viability.

Conclusion

Sri Lanka’s $3.7 billion deal with Sinopec is a landmark agreement with the potential to transform the nation’s economic and strategic standing. However, it also brings challenges and geopolitical complexities. By addressing these issues proactively, Lanka can leverage this investment to secure a brighter future. As the project unfolds, all eyes will be on Hambantota to see if it becomes a beacon of prosperity or a flashpoint in global rivalries.

Also Read-

1. Imran Khan’s Shocking 14-Year Sentence: Is Pakistan

3. TikTok Ban Looms: 5 Critical Questions About the App’s Future in the U.S.